The dawn of Artificial Intelligence has been nothing short of electrifying. From automating mundane tasks to powering groundbreaking scientific discoveries, AI promises to reshape industries and redefine human potential. This technological revolution has, predictably, sent ripples of euphoria through financial markets, propelling the stocks of AI-focused companies to dizzying heights. Yet, amidst the celebratory headlines and booming valuations, a growing chorus of caution is emerging from the very heart of global finance. Is this the unstoppable march of progress, or are we witnessing the familiar inflation of a speculative bubble, destined to echo the infamous dot-com bust?

The Uncomfortable Truth from Global Fund Managers

A recent survey by Bank of America, highlighted by Bloomberg, reveals a significant unease among the world`s financial stewards. Out of 166 fund managers, collectively overseeing assets worth a staggering $400 billion, a notable 54% believe that the valuations of AI companies are simply too high. This isn`t just a handful of skeptics; it`s a majority of seasoned professionals who are starting to question whether market enthusiasm has outpaced fundamental reality.

For context, the NASDAQ-100 index, often seen as a barometer for tech stocks, has surged by 18% this year, largely on the back of the AI hype. This rapid ascent, while exhilarating for investors riding the wave, is precisely what triggers alarm bells for those who remember previous market excesses. After all, when half of those managing billions begin to murmur about overpricing, it`s rarely just a passing thought.

Echoes of the Past: The Dot-Com Deja Vu

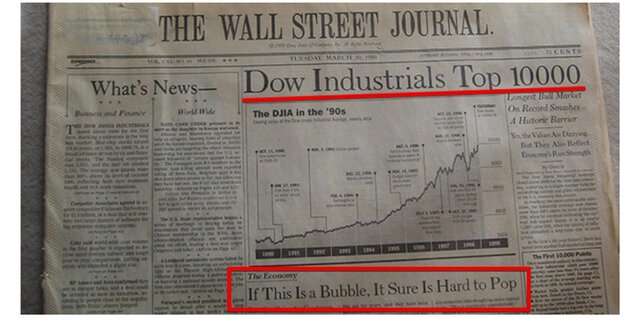

The parallels to the late 1990s dot-com bubble are becoming increasingly difficult to ignore. Back then, any company with “.com” in its name could command exorbitant valuations, often with little to no revenue or clear path to profitability. The promise of a new internet-driven economy overshadowed sound financial analysis, until, inevitably, the bubble burst, wiping out trillions in market value and teaching a painful lesson in speculative fervor.

It`s a history lesson that the International Monetary Fund (IMF) is keen for investors not to forget. Pierre-Olivier Gourinchas, the IMF`s Chief Economist, has issued stark warnings about the potential for the current AI bubble to burst, drawing explicit comparisons to the early 2000s tech crash. The message is clear: while AI`s potential is undeniable, market expectations might be running dangerously ahead of actual, sustainable returns. History, it seems, has a peculiar way of rhyming, especially when it comes to speculative frenzies.

What Fuels the AI Fire? Innovation or Over-Optimism?

So, what`s driving this phenomenal growth, and is it entirely unfounded? The answer, as always, is nuanced. There`s no denying the genuine innovation happening in the AI sector. Tech titans, often dubbed the “Magnificent Seven” (think Microsoft, Google, and others), are pouring billions into AI research and development, creating advanced large language models and other transformative technologies. The underlying technology is robust, and its potential applications are vast.

According to Vladimir Popov, an asset manager, the situation isn`t a simple case of blind speculation:

“To say there`s a bubble now, yes, one could argue that. But how long it will last, no one knows. Since the fundamental indicators of these companies support their stock growth and follow them, this bubble might continue to inflate for some time.”

Popov highlights that robust fundamental growth, fueled by massive investments and tangible technological advancements, is a key differentiator from pure speculative frenzy. The widespread adoption of AI across various business sectors, beyond just the core AI producers, could also sustain growth, allowing capital to flow into new applications. This suggests that while a bubble might exist, it`s not merely hot air, but rather an inflated balloon with a powerful engine.

The Global Race and the Shifting Sands

The AI revolution isn`t confined to Silicon Valley. European nations, including France, the Netherlands, and the UK, are actively striving to develop their own large language models, indicating a global race for AI dominance. This competitive landscape could further accelerate innovation, but also intensify the pressure on valuations as more players enter the arena. Everyone, it seems, wants a piece of the AI pie.

The Federal Reserve`s monetary policy also looms large over the market. Interest rate decisions can significantly impact investor appetite for riskier growth stocks, adding another layer of complexity to the AI market`s trajectory. A tightening monetary policy could easily prick a balloon already stretched thin.

Navigating the Hype Cycle: A Concluding Thought

The question isn`t whether AI is revolutionary, but whether its current market valuation reflects a realistic future or a collective fantasy. Fund managers, with their fiduciary duty, are right to sound the alarm, reminding us that even the most transformative technologies are subject to economic gravity.

As investors grapple with this high-stakes scenario, the wisdom lies in discerning genuine, sustainable growth from mere speculative froth. History, in its recurring patterns, offers a powerful, albeit often ignored, reminder: true innovation endures, but unchecked euphoria rarely does. So, while we stand on the precipice of AI`s golden age, perhaps a touch of prudent skepticism is the most intelligent algorithm to follow. After all, the market is a grand theater, and we`ve seen this play before.