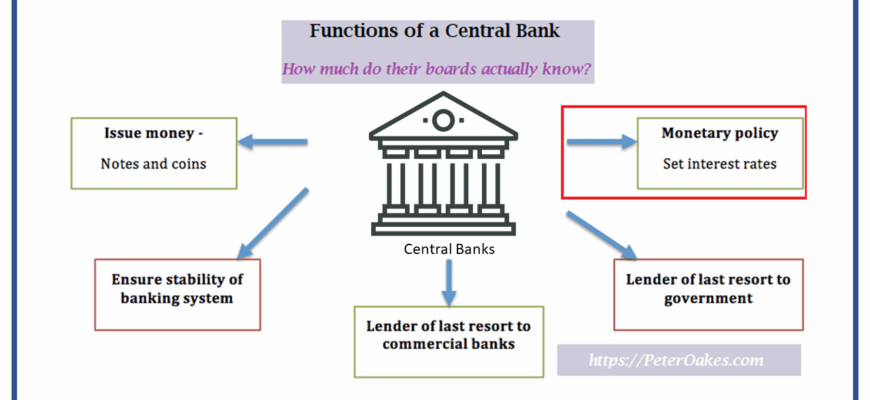

In the often-unpredictable world of global economics, central banks play a role akin to a maestro conducting a symphony – sometimes grand and sweeping, at other times subtle and nuanced. Recently, one prominent Central Bank concluded a period of aggressive interest rate hikes, pivoting instead to a strategy of reduction. This shift, from a stern anti-inflationary stance to a more accommodating position, has raised questions and keen interest among market observers. What exactly prompts such a significant change in monetary policy, and what are its broader implications?

The Climb: Why Rates Went Up

For months, the economic narrative was dominated by rising inflation. Prices for everything from groceries to gasoline seemed intent on reaching for the skies, prompting central banks worldwide to take decisive action. In the case of the Central Bank in question, the key interest rate was systematically elevated, surging from 16% to a formidable 21%. This wasn`t a casual decision; it was a strategic maneuver designed to cool down an overheating economy, dampen consumer spending, and ultimately, bring inflation back to more manageable levels. Higher interest rates make borrowing more expensive, discouraging investment and consumption, thus reining in price pressures. It`s the economic equivalent of taking your foot off the accelerator and firmly pressing the brake.

The Descent: A Calculated Reversal

Fast forward to the present, and the tune has changed. The same Central Bank, having previously tightened the screws, has now begun to lower its key interest rate. This isn`t a sign of indecision, but rather a calculated response to evolving economic realities. As experts like Igor Nikolaev, Chief Researcher at the Institute of Economics of the Russian Academy of Sciences, would likely articulate, such reversals are typically driven by a combination of factors:

- Inflation Moderation: The primary reason for rate hikes begins to dissipate. If inflation shows signs of cooling and stabilizing within acceptable targets, the immediate need for restrictive policy lessens. The brakes, having served their purpose, can now be eased.

- Economic Slowdown Concerns: Aggressive rate hikes, while effective against inflation, can stifle economic growth. Businesses find it harder to borrow and expand, consumer demand wanes, and overall economic activity can slow. A central bank, ever watchful of a potential recession, might lower rates to inject liquidity and stimulate activity.

- Financial Stability: In some scenarios, very high rates can stress the financial system. Reducing them can alleviate pressure on borrowers and banks, promoting stability.

- Anticipation of Future Trends: Sometimes, central banks act preemptively, anticipating future economic downturns or further moderation in inflation, positioning the economy for a smoother landing or a quicker recovery.

“Central banking is a delicate dance between preventing runaway inflation and avoiding an economic standstill. Lowering rates after a significant increase often signals a cautious optimism that the former battle is being won, allowing focus to shift to fostering growth without reigniting price pressures.”

Implications for the Economy and Everyday Life

The impact of a key interest rate reduction ripples through the entire economy, affecting everyone from large corporations to individual households:

For Consumers:

- Cheaper Loans: Mortgage rates, car loans, and credit card interest rates may begin to fall. This makes borrowing more affordable, potentially stimulating demand for big-ticket items.

- Savings Rates: Conversely, returns on savings accounts and fixed deposits might decrease, nudging consumers to consider investing or spending rather than holding cash.

For Businesses:

- Reduced Borrowing Costs: Companies can access capital more cheaply, encouraging investment in expansion, hiring, and research & development.

- Increased Demand: As consumers find it easier to borrow and spend, overall demand for goods and services can pick up, boosting business revenues.

For the Broader Market:

- Stock Market Rally: Lower interest rates generally make equities more attractive compared to fixed-income investments, potentially leading to a stock market rally.

- Currency Impact: A rate cut can sometimes lead to a weakening of the domestic currency, making exports cheaper and imports more expensive.

The Art of the Pivot

Changing course in monetary policy is no small feat. It requires a keen understanding of complex economic indicators, a robust analytical framework, and a healthy dose of foresight. The Central Bank`s decision to shift from aggressive tightening to cautious easing underscores the dynamic nature of economic management. It`s a pragmatic recognition that while inflation must be tamed, the economy also needs room to breathe and grow.

Ultimately, these adjustments are about finding equilibrium – a sweet spot where prices are stable, employment is high, and the economy can flourish without succumbing to either rampant inflation or stifling stagnation. The path is rarely straight, and central bankers, with their levers of power, continue their intricate monetary dance, always with an eye on the delicate balance.