The dream of homeownership often comes with a hefty price tag, and for many, that tag is heavily influenced by one critical factor: mortgage interest rates. It`s a question that keeps prospective buyers awake at night and has economists peering into their crystal balls: when will the rates finally recede, making that dream home just a little more accessible? This enduring query recently took center stage with insights from a distinguished expert, Igor Nikolaev, Chief Researcher at the Institute of Economics of the Russian Academy of Sciences, who delved into the complex interplay between central bank policies and the cost of borrowing for homes.

The Central Bank`s Lever: Understanding the Key Rate

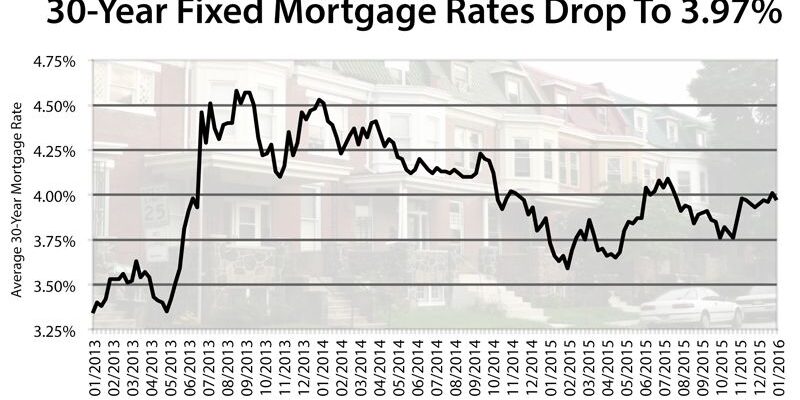

At the heart of mortgage rate fluctuations lies the central bank`s key rate, often referred to as the policy rate or benchmark rate. This seemingly abstract figure is, in reality, a powerful lever that dictates the broader economic landscape. When a central bank, like the Bank of Russia or the Federal Reserve, adjusts this rate, it sends ripples throughout the financial system, directly impacting how much commercial banks pay to borrow money. Naturally, these costs are then passed on to consumers in the form of loans, including mortgages.

“Think of the key rate as the thermostat for the economy,” explains Igor Nikolaev. “When it`s raised, borrowing becomes more expensive, cooling down spending and theoretically curbing inflation. When lowered, it’s meant to stimulate economic activity, making loans cheaper and encouraging investment and consumption.”

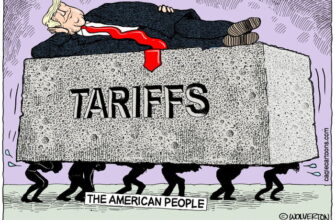

For the average homebuyer, a lower key rate translates to lower mortgage rates, reducing monthly payments and potentially saving tens of thousands over the life of a loan. Conversely, a higher key rate can put homeownership out of reach for many, or at least make it a much more financially strenuous endeavor.

The Economic Barometer: What Drives Rate Decisions?

Central banks don`t whimsically change rates. Their decisions are meticulously calculated, weighing a multitude of economic indicators. The primary concern is often inflation – the rate at which prices for goods and services are rising. If inflation is high and persistent, central banks tend to raise rates to cool down the economy. If inflation is under control and the economy shows signs of slowing, they might consider rate cuts to spur growth.

Other critical factors include:

- Economic Growth: A robust economy might withstand higher rates, while a struggling one may need the boost of lower rates.

- Employment Levels: High unemployment can signal a need for stimulus, which often comes with lower rates.

- Geopolitical Stability: External shocks or uncertainties can lead central banks to act cautiously, sometimes keeping rates higher to buffer against potential economic fallout.

According to experts like Nikolaev, predicting these moves requires a deep understanding of both domestic and global economic currents. It`s less about a precise timeline and more about interpreting the ongoing economic narrative.

The Buyer`s Conundrum: To Wait or Not to Wait?

For individuals eyeing a mortgage, the expert discussion inevitably leads to the burning question: Is now the right time, or should one patiently wait for rates to drop? The answer, as is often the case in economics, is nuanced and rarely definitive.

Waiting for an ideal rate can be a gamble. While rates might indeed fall, they could also remain stubbornly high, or even climb further. Property prices, another critical variable, do not always move in lockstep with interest rates. A significant drop in rates might coincide with a surge in demand, pushing property values upwards and potentially negating the savings from a lower interest rate.

Igor Nikolaev`s perspective often emphasizes a pragmatic approach: focus on personal financial stability rather than solely on market timing. If your personal finances are robust, your income secure, and the property you desire is available at a reasonable price, then waiting for a hypothetical future rate could mean missing out on a suitable home. Conversely, stretching your budget to buy at high rates, hoping for a future refinancing opportunity, carries its own set of risks.

Beyond the Rate: What Else Matters for Homebuyers

While interest rates command much of the spotlight, a truly informed decision to purchase a home requires a broader perspective. Buyers should also consider:

- Personal Financial Health: Your debt-to-income ratio, credit score, and savings for a down payment are paramount.

- Long-Term Plans: How long do you plan to stay in the home? Short-term plans might justify different financial strategies than long-term ones.

- Local Market Conditions: Is it a buyer`s or seller`s market? Are property values appreciating or depreciating in your desired area?

- Refinancing Options: Even if you buy at a higher rate, understanding future refinancing possibilities can provide peace of mind.

The journey to homeownership is a marathon, not a sprint, and navigating its financial complexities requires more than just hoping for a rate cut. It demands careful planning, a realistic assessment of one`s financial standing, and an informed understanding of the economic currents.

Ultimately, the expert consensus, as often echoed by figures like Igor Nikolaev, leans towards a balanced view: economic indicators will continue their elaborate dance, and central banks will react accordingly. While anticipating a perfect market entry point is akin to finding a needle in a haystack, staying informed and prepared remains the most robust strategy for anyone looking to secure their slice of the real estate pie. The question of “when” might remain, but the tools for making a smart decision are always at hand.