For decades, the path to financial stability and personal fulfillment often seemed paved with the acquisition of property. The mortgage, a financial instrument as old as modern banking, was the essential key. It allowed families to transition from the perceived transience of renting to the tangible permanence of owning a home, fostering a sense of rootedness and a seemingly secure investment. But what happens when the very foundations of this long-held wisdom begin to shift?

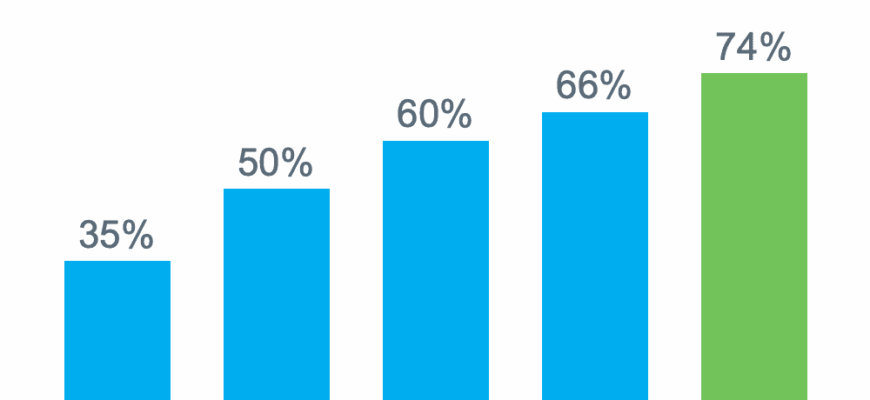

The Shifting Sands of Interest Rates

Recent economic fluctuations, most notably the significant rise in central bank key interest rates across various global economies, have prompted a fundamental re-evaluation of this long-cherished paradigm. The immediate impact is clear: borrowing money has become considerably more expensive. For the average prospective homeowner, this translates directly into higher monthly mortgage payments, often making the once-attainable dream feel increasingly out of reach.

This economic reality challenges the romantic notion that a mortgage is inherently superior to rent. Historically, renting was often seen as “throwing money away,” a temporary stopgap before achieving the ultimate goal of homeownership. This perspective, while emotionally resonant, frequently overlooked the significant ancillary costs of owning, from property taxes and maintenance to insurance and, crucially, interest payments that could span decades.

Rethinking the Rent-or-Buy Equation

In an environment where mortgage rates hover at levels unseen for years, the calculus shifts dramatically. Suddenly, the “wasted” rent payment might seem less wasteful when compared to a mortgage payment that barely covers the principal, with the bulk swallowed by interest. The flexibility of renting, once considered a downside, now appears as a strategic advantage. Renters are not tied to a single location, offering agility in career moves or lifestyle changes without the cumbersome process of selling property. They are also insulated from immediate property value depreciation, a risk that looms larger in uncertain markets.

“The traditional wisdom dictating that `renting is throwing money away` is undergoing a severe stress test. In high-interest environments, the concept of building equity slowly while paying substantial interest might just be a different form of `throwing money away,` albeit with a title deed.”

What Experts Are Seeing: A New Definition of “Priority”

Financial experts, observing these shifts, note a change in what constitutes a “priority” for potential buyers. It`s no longer just about securing a roof over one`s head at any cost. The focus is increasingly on:

- Financial Liquidity: Maintaining accessible funds for other investments or unforeseen circumstances, rather than tying up a vast majority of capital in a single, illiquid asset.

- Investment Diversification: With real estate investment yielding diminished returns due to high borrowing costs, individuals are exploring alternative avenues for wealth creation, such as diversified stock portfolios or other market instruments that might offer better risk-adjusted returns.

- Long-Term Affordability: A deeper scrutiny of not just the initial mortgage payment, but the long-term commitment and how it aligns with projected income and lifestyle goals. The desire to avoid being “house-poor” is paramount.

- Lifestyle Considerations: The evolving preferences of younger generations often prioritize experiences, travel, and flexibility over the perceived burden of long-term debt and property maintenance.

This isn`t to say that homeownership is obsolete. For many, it remains a profound personal aspiration and, under the right conditions, a sound financial decision. However, the current economic climate demands a more pragmatic and less emotional approach. The default assumption that a mortgage is always the best path forward is being replaced by a nuanced assessment of individual financial circumstances, market conditions, and personal priorities.

The Future of Housing: Adapt or Perish (Financially)

The conversation around mortgages has evolved from a simple “yes or no” to a complex “it depends.” It depends on interest rates, personal financial resilience, career trajectory, and even one`s philosophy on asset ownership. The housing market, much like the broader economy, is a dynamic entity. Those who navigate it successfully in the modern era will be those who adapt their strategies, question conventional wisdom, and prioritize financial prudence over historical narratives.

Perhaps the true lesson is not that mortgages are irrelevant, but that their relevance is now contingent on a far wider array of factors than ever before. The “homeownership dream” hasn`t vanished, but it has certainly matured, shedding some of its romantic sheen for a harder, more analytical gleam.