In a plot twist worthy of a geopolitical thriller, recent economic data suggests that Western sanctions, intended to cripple Russia’s financial system, may have inadvertently accelerated a significant shift in its international trade practices. Far from isolating the ruble, these measures appear to be driving its adoption in a substantial portion of Russia`s export payments, creating an intriguing dynamic in global finance.

The Ruble`s Resurgence in Export Settlements

Recent figures from the Russian Central Bank, as highlighted by a Bloomberg report, reveal a stark transformation: more than half of Russia’s exports are now being paid for in rubles. This is not merely a marginal increase; it’s a profound recalibration of trade mechanisms. To put this into perspective, a significant shift has occurred from traditional Western currencies to domestic and “friendly” alternatives.

Beyond the ruble, approximately one-third of Russia`s export earnings now come in what Moscow terms “friendly” currencies. These typically include the Chinese yuan, Indian rupee, and other currencies from nations that have not joined the Western sanctions regime. This leaves a surprisingly small slice—just 15%—of Russia`s export revenue being settled in currencies deemed “unfriendly,” such as the US dollar and the Euro.

A Strategic Shift or a Forced Adaptation?

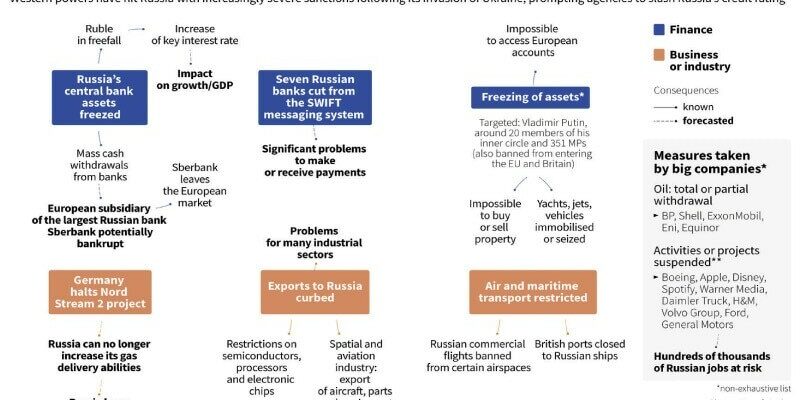

This rapid “rublification” and diversification of payment methods is fundamentally a direct consequence of the extensive financial restrictions imposed by Western nations. When traditional channels for dollar and euro transactions became constricted or outright blocked, Russia, along with its trading partners, was compelled to seek alternatives. This necessity quickly evolved into a strategic imperative.

“The very measures designed to isolate Russia financially,” a seasoned financial observer might note, “appear to have inadvertently catalyzed its efforts to reduce reliance on the global financial architecture dominated by Western currencies. It`s a classic case of an intended pressure point becoming a propellant for an alternative strategy.”

For Moscow, the goal extends beyond merely circumventing sanctions; it is about a long-term push towards de-dollarization and establishing a more resilient financial system less susceptible to external pressures. By promoting the ruble in international trade, Russia aims to increase its currency’s global standing and reduce its vulnerability to fluctuations and political weaponization of reserve currencies.

Implications for the Global Financial Landscape

The increasing role of the ruble in Russian export payments, alongside the rise of other “friendly” currencies, signals a broader trend in global trade: the diversification away from traditionally dominant currencies. While the US dollar and Euro remain pivotal in global commerce, this development from a major energy and commodity exporter like Russia offers a compelling case study for other nations looking to reduce their own reliance on a single, or a few, dominant currencies.

This shift isn`t without its complexities. For importing nations, trading in rubles or other non-traditional currencies can introduce new challenges related to liquidity, currency conversion costs, and market depth. However, for those keen on maintaining trade relationships with Russia, these challenges are evidently surmountable, demonstrating a willingness to adapt to new payment paradigms.

Looking Ahead: A New Financial Order?

The trajectory of Russia’s export payment structure points to a financial system that is becoming increasingly fragmented. Instead of a universally accepted single currency, we may be observing the emergence of regional currency blocs or bilateral agreements that bypass traditional Western-centric financial networks.

As the world continues to grapple with geopolitical fragmentation, the ruble’s unexpected rise in international trade settlements serves as a potent reminder that every action, especially in complex global systems, carries the potential for unforeseen, and sometimes ironic, reactions. The grand experiment of economic pressure is yielding results, just perhaps not always the ones initially envisioned by its architects.